Return to the office — but change your approach

As COVID-19 shut down offices across the world, major tech hubs with their elaborate office spaces shuttered. The entire industry began to wonder, “how will it be possible to keep our unique culture alive over video conferences?”

But now as we see real hope for going back to an in-person setting, the new burning question has become, “how will we adjust and recreate culture and encourage attendance once it’s time to return?”

There is, of course, no right answer to these questions just yet — sorry.

However, I believe changing how we think about returning to the office in the months to come — especially by fostering an office environment that acts as a ‘home base’ — will be vital to building a comfortable foundation for return-to-work company-wide.

The complexities of choosing a “return date” and a return-to-work policy while managing to welcome back employees in a meaningful way, however, is presenting a new challenge for executive decision-makers as the expectation to begin “returning to normal” is upon us.

A new perspective on returning to the office

For my company, we left our respective workspaces earlier this year when it became clear a return to work would not be in the cards in the short term. This move has placated a lot of employees’ stress about commuting, sharing small spaces, and leaving the comfort of their home offices.

While the first six months of quarantine felt like a struggle, once our employees really hit their stride and built new routines, they found the convenience of working from home a bonus that they don’t want to give up entirely when a “new normal” kicks off.

So when it comes to the timing of a return-to-work plan, I’ve seen that not having the stress of a strict return date has made our employees more relaxed, and more focused on productivity while working from home.

Although a hybrid remote work model is going to be paramount to a smooth transition once return-to-work planning is initiated again, we won’t be able to do it with our old, rigid offices. That’s why I think it’s imperative that we redefine our office space from a 9 a to 6 grind to a more flexible setting.

Employees have gotten used to being able to better balance at-home responsibilities with work responsibilities; blending their work hours with their personal hours in a way that ensures both are met with high productivity.

The potential for a more flexible work schedule is extremely desirable for employees and management alike as well as when it comes to the recruitment of new hires, adding curbside appeal and eliminating the various pressures that once were. So f ostering a ‘home base’ for employees company-wide removes the added stress of the somewhat dreaded change of routine on their psyche.

Reset for a culture-focused future

When we do return to work, everything will not just simply pick up where it left off over a year ago.

Most companies, including Tapad, will be looking for a whole new kind of space — one that allows for separation between employees, but still offers some of those cultural tentpoles like kitchen amenities. Basically — say buh-bye to the often-debated “open floor plan” with rows of desks with employees spaced only two feet apart.

Thankfully, ping pong is a socially distant sport, so I’ll expect to see ping pong tables and revamped spectator spaces continue to be core to culture building in our new home base.

Ping pong aside though, it’s essential that companies look to this return to normalcy as a reset button. So much has happened in the past year across personal lives, work lives, and just in the world in general. It’s imperative that companies look at this return as an opportunity for a cultural reset.

How do we foster more inclusivity, celebrate our people more collectively and build cultural programs that work in the new future? The answer is not going to come from one person, but rather from the feedback and participation of as many employees as possible.

The adoption of a hybrid remote-work model will mean fewer people in the office at the same time, so a fresh slate of programming is essential. A mix of virtual and physical events, regularly scheduled ‘face time’ with management, and of course, new swag to make sure employees feel connected and excited to start integrating back into office life.

Just like we experimented throughout 2020 and 2021 to find the right cadence of town halls and virtual happy hours, we’ll need time to experiment with hybrid culture to find the right blend of activities and content to keep everyone feeling engaged and motivated.

It’s going to be critical for employers not to glaze over this past year and expect team members to be able to do the same. A successful return-to-work is going to require acknowledgment that ‘going to work’ is not going to be the same for a long time, or ever even.

And while there is no perfect plan or formula, I believe it’s important that employees see the effort going into creating a new culture. The more transparency there is in building back up an encouraging workplace culture, the more teams feel, understand, and adapt to the initiatives and environments.

A look inside Europe’s $7 trillion technology market

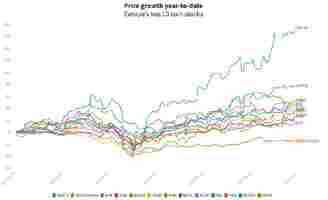

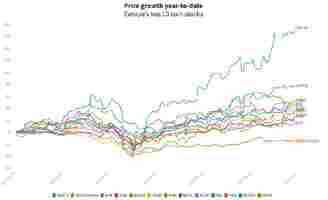

There’s no doubt US tech stocks have thrived in 2020, but a raft of their European counterparts have returned huge profits for investors during the first six months of this year.

Sinch, the Stockholm-based cloud telecoms firm, is up a teeth-kissing 170% year-to-date. Second-best is Dutch fintech play Adyen: its market cap grew from $223 billion to $389.4 billion, driving its stock price up by 74%.

Swedish accounting gem Fortnox just beat Germany’s TeamViewer for third place, but they were close, both up around 52% in the past six months. It’s far less than its US counterpart Zoom Video , but still impressive.

Dutch tech stocks lead Europe in 2020

In a bid to map Europe‘s € 6.12 trillion ($6.95 trillion) technology market, Hard Fork analyzed the 72 companies listed as “Information Technology” in the MSCI Europe Investable Market Index , as tracked by BlackRock’s corresponding iShares ETF. It follows almost 1,000 stocks of all kinds across Europe.

MSCI notes that its IMI market index represents “99% of the free float-adjusted market capitalization across the Developed Markets countries of Europe.” A number of European countries are absent from the IMI market index; many are classified as “emerging markets,” so they were not included in this analysis.

The heat map below shows weighted growth of each country’s technology market values. Countries in the deepest blues are home to tech firms that added the most value to their market caps. Those in the red hue have lost value in 2020.

(NB: If the visualization doesn’t show, please try reloading this page in your browser’s “Desktop Mode.”)

Turns out, Holland’s four tech companies put their nation way ahead of the rest of Europe. Previously mentioned Adyen grew 74.64%, supported by a trio of semiconductor firms: ASM, ASML, and BESI, which grew 34%, 21%, and 11% respectively.

This gave the Netherlands a growth rate of just under 30%.

Italian fintech incumbent NEXI’s value swelled by more than 22% this year, which pushed its native homeland to second place. If its public tech companies were the entire nation, Italy would’ve grown by more than 17% this year.

The method

The growth of each country is value-weighted, much like the S&P 500 stock index. With this method, companies with the largest market values (traditionally the most “stable”) affect the growth rate of their country the most.

Take Finland, home to two public tech companies with vastly different market caps: phone lords Nokia with $24.72 billion; and IT wizards Tieto with a little over $3 billion. The average market cap of those two companies gives Finland’s weighted market value.

Nokia’s market value grew by 12.35%, while Tieto’s is down 12.71%. But, after comparing Finland’s weighted market cap at the start of the year to the end of June, Finland ends up posting a growth rate of 8.72%.

After all, Nokia is a vastly bigger company, so its growth should be worth more to Finland overall.

Unfortunately for Spain, lacklustre performances from its two public tech companies put it at the bottom of the rankings for at least the first half of 2020.

Dominion, IT services provider for engineering sector, shrunk by 24%. Fellow IT services firm Armadeus was hit worse, likely due to its connection to the global travel and tourism industry; its market value more than halved this year. This gave Spain a growth rate of -49%.

Using the same method to benchmark Europe‘s tech market as a whole, we found its growth rate for the first half of 2020 to be -6.8%. You can check out Hard Fork’s European tech stock spreadsheet in full here .

Still, there’s been loads of opportunity in Europe this year, but odds are you would’ve found it in the Netherlands. Super lekker.

What Europe’s entrepreneurs can learn from DeepCrawl’s US expansion

International expansion for European companies is never easy, particularly in the USA. The rewards can be vast, but the risks can be equally significant. Many companies will overstretch and overspend, struggling to win market share in such a competitive economy.

When DeepCrawl closed its $19 million Series B led by Five Elms in March, it marked another significant step in its transatlantic journey. Having worked with the leadership team at DeepCrawl since 2017, I have seen a business take these challenges in its stride, building its own successful approach to international expansion and reaping the substantial rewards that America can offer a scaling company.

Founded in London in 2010, DeepCrawl sought to help companies grapple with the increasing complexity of website architecture. It has since scaled to become an international success story with offices spanning the UK, USA, and Europe. Today, DeepCrawl generates over 60% of its revenues in North America, and it secured its latest funding from a US VC — so it’s definitely an example worth following.

I have learnt a lot from this experience, and I hope that these lessons can support another cohort of European entrepreneurs to follow in the footsteps of DeepCrawl, establishing a success story in the US and securing funding from American VCs.

Boots on the ground: building a US presence

Making the journey across the Atlantic is not easy. From the outset, there is a lengthy list of questions facing any leadership team that is seeking to take a business into the US.

First, “who will be our boots on the ground?” Should responsibility for the expansion lie with the founders? Are there existing members of the leadership team with the depth of knowledge about the business that could fly the flag in America?

For the majority of European SaaS companies like DeepCrawl, expanding into the US is driven by a desire to grow sales. Many businesses look to recruit someone with a proven track record and a ready-made roster of potential customers. These experienced sales leaders are costly hires, and they should be treated with caution.

DeepCrawl took a different approach. For the founders, passion for the product and a shared culture of success were as important as years of experience on a CV. The company therefore chose to hire Alex Schaefer, who had demonstrated his drive to be an integral part of a growth story in an early chapter of his career, rather than an expensive black book of corporate contacts. This grit and energy has been immensely valuable to DeepCrawl’s expansion.

“Where do we base ourselves?” Location is typically second on the list of key questions. With clients on both coasts, DeepCrawl decided to situate themselves in New York — close enough to London to facilitate travel between the offices and dialogue between teams, it has proved a valuable decision.

Identifying product niches: scaling from an SEO tool to a developer platform

When the three co-founders of DeepCrawl established the business in 2010, it sought to map, track, and manage the increasing complexity of website architecture. Immediately, there was a clear product-market fit, as few companies were able to crawl and catalogue vast sites.

In many instances, companies were simply unable to understand quickly what information was held across a website. As Michal Magdziarz, CEO of DeepCrawl, puts it: “If you owned a chain of coffee shops, you would know what you owned and where it was kept — the same was not true of websites.”

The American technology industry is product obsessed. It is a technical and competitive landscape where only the leading innovators can cut through. Companies looking to establish a foothold in this environment must put product at the heart of their journey and develop an acute sense of what a customer needs to succeed.

From day one, the co-founders of DeepCrawl have shown a clear understanding of what their customers required, and built a product tailored to their needs. The platform that they built provided immediate insights into the architecture, health, and SEO performance of a website, which was vital to brands and retailers on both sides of the Atlantic.

A keen eye for innovation has been maintained as the business has scaled, and the DeepCrawl team has listened once again to the needs of its customers to build its latest product, Automator. Companies with substantial websites are in a constant process of releasing new code. If not properly tested, these changes can have a dramatic impact on the SEO performance of a website — a problem that can often go undetected for days or even weeks.

Automator will allow engineering teams to test new code for its impact on SEO performance before it goes live. The potential of this product is vast, and it has been a vital foundation for the growth story behind securing DeepCrawl’s substantial Series B.

I would, therefore, advise any company seeking to expand in the US to reflect on your product, take an honest look at how it compares to American competition, and think tirelessly about how it might be honed to cut through in a product obsessed market.

Singing from the same hymn sheet: the value of OKRs

Building an international presence brings other operational headaches. With offices in London, New York, and Krakow, DeepCrawl has a global team that it must ensure remains aligned upon common objectives.

Likewise, working with the likes of IKEA, Shopify, and Nestlé, DeepCrawl has an international client base needing the attention and support of customer success and technical teams throughout the day. In order to succeed as a global organization, Michal and the DeepCrawl leadership created a strong sense of shared ownership and collaboration across its international offices.

In this context, I believe that the implementation of OKRs — objectives and key results, a framework for defining and tracking goals and outcomes — across the business has driven a culture of success. The OKRs implemented throughout DeepCrawl create a unity and accountability in the team that you do not often see, and it has certainly been a key factor in driving the business forward.

I look forward to seeing where the DeepCrawl journey goes from here, and I hope that a future generation of European entrepreneurs will learn from its successes and reap the rewards of expanding in the US.